2010 Identity Theft Statistics Released

The 2011 Identity Fraud Survey Report by Javelin was just released, and it shows new trends in identity theft. While the report states that identity theft cases have decreased overall, it is costing consumers more time and money. The good news is that the drive to increase awareness about identity theft is working.

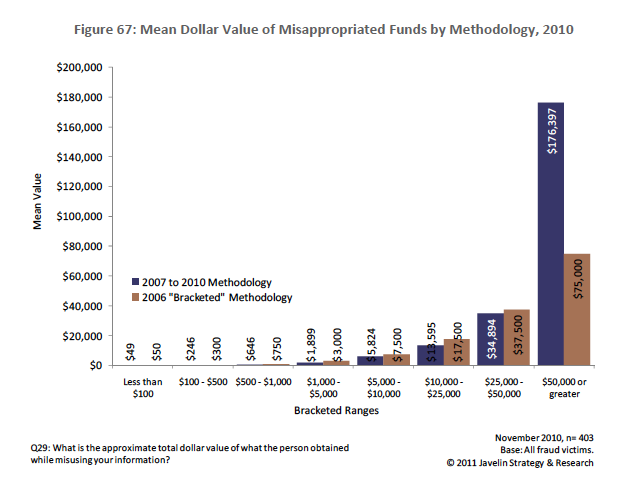

Meanwhile, consumer costs, the average out-of-pocket dollar amount victims pay, increased, reversing a downward trend in recent years. This increase can be attributed to new account fraud, which showed longer periods of misuse and detection and therefore more dollar losses associated with it than any other type of fraud. – Javelin Strategy & Research

The cost to resolve identity fraud issues rose dramatically in 2010 because there was a change in the type of fraud that was being committed. New Account fraud is on the rise and this is the hardest type to detect and costs the victim the most. The majority of thieves who use friendly fraud, where they target friends and relatives they know, are able to do a lot of damage by setting up new accounts in the victim’s name. Since the victim has no idea that they are a victim, they can continue to use their identity longer, which racks up more financial theft.

Rising problems include account takeover, friendly fraud, and people failing to use privacy settings on social networks. Too few consumers are failing to protect their data, ranging from lack of anti-malware software on personal devices, mailing paper checks or financial statements, and weak online passwords. Individuals need to do a better job monitoring their personal information (limit what you give when opening new accounts) and monitoring current accounts with text and email alerts for money spent and other transactions.

Javelin found that 48% of all reported identity fraud cases were first detected by consumers, which reinforces that we need to monitor our accounts regularly. Another important way to protect yourself it to order, review, and know what is on your credit report. You can do this at least 3 times a year for free. Consumers can request a copy of their credit report from one of the three nationwide credit reporting agencies through AnnualCreditReport.com.

John Sileo’s motivational keynote speeches train organizations to play aggressive information offense before the attack, whether that is identity theft, data breach, cyber crime, social networking exposure or human fraud. Learn more at www.ThinkLikeASpy.com or call him directly on 800.258.8076.

Sorry, comments for this entry are closed at this time.

No Comments Yet

You can be the first to comment!