Home | Solutions Blog | credit card fraud

Posts tagged "credit card fraud"

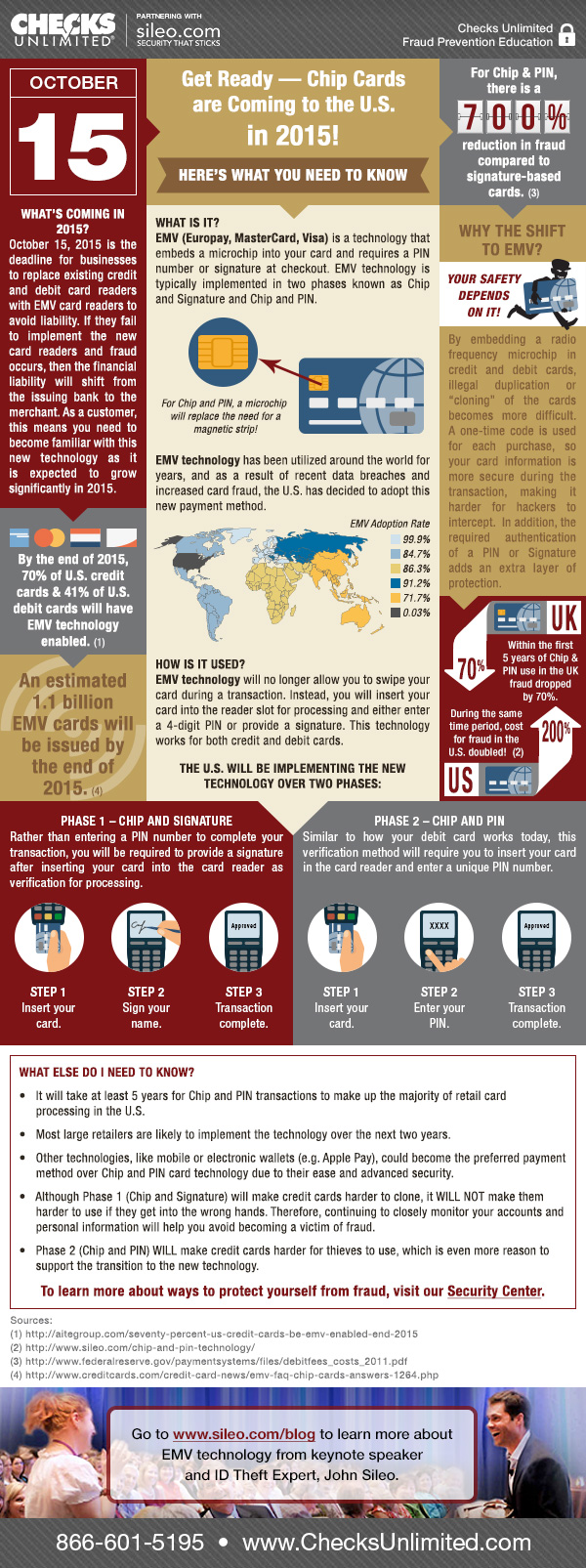

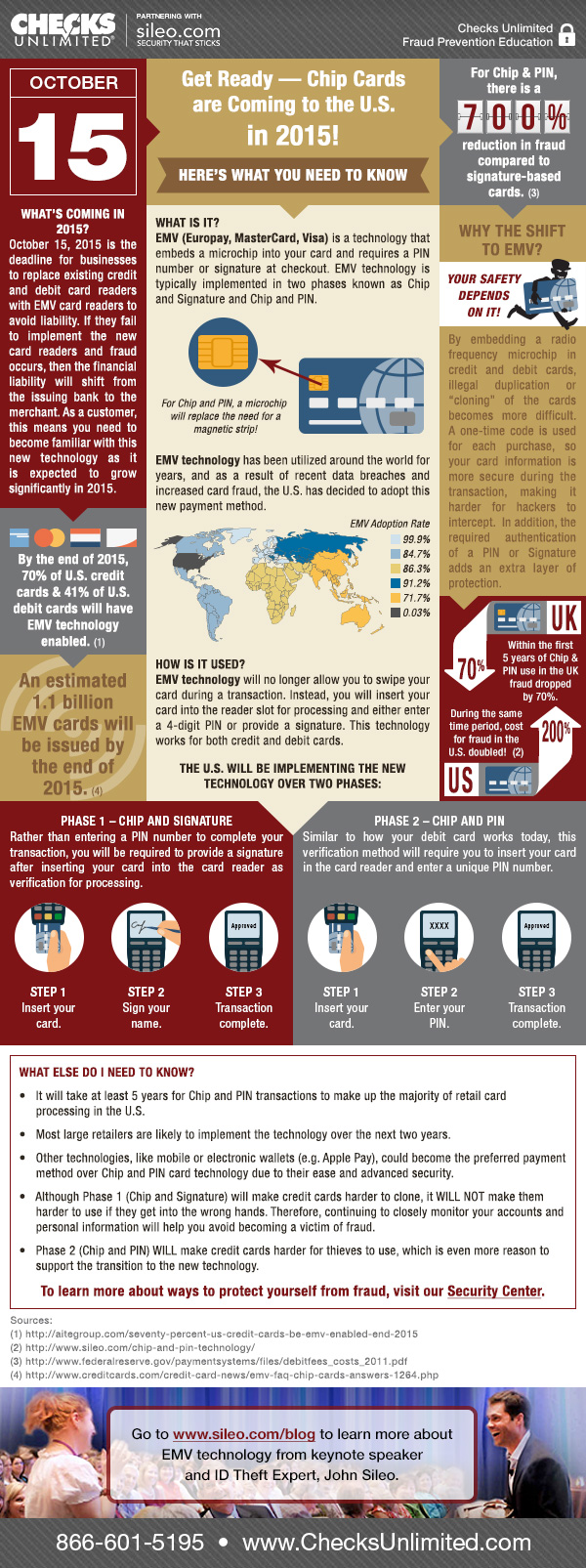

Chip and Pin Credit Cards Lower Fraud by 700%

- It will take at least 5 years for Chip and PIN (or EMV) transactions to make up the majority of retail card processing in the U.S.

- Most large retailers are likely to implement Chip and PIN technology over the next two years

- Other technologies, like mobile or electronic wallets (e.g. Apple Pay), could become the preferred payment method over Chip and PIN card technology due to their ease and advanced security.

Posted in Cyber Data Security, Fraud Detection & Prevention, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Chip and Pin, credit card fraud, Credit Card Security, Credit Cards, EMV

[youtube http://www.youtube.com/watch?v=HEZkPZlskh0&rel=0]

You’ve probably heard that instead of signing the back of your credit card, you can protect yourself by putting the words “Photo ID required” or “See photo ID”. So we went out to test this method to see if it actually gets people to do that. I presented my card at various shops (sporting goods stores, frozen yogurt stands, fast food joints…) and filmed the transactions. In this small sampling, I found five who did not ask for my ID and six that did.

I wonder if you can guess what the difference is between the people who didn’t ask for my ID and the ones who did. The answer? I had written “Photo ID Req’d.” on the FRONT of my card (in several places, in fact) in the cases where it was requested and only on the back where it was not.

Posted in Burning Questions (Video), Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Ask for ID, credit card fraud, Credit Card Protection, Photo ID Required, See Photo ID

In a town with a population of about 3,000 people it seems that almost all the citizens of Bennett, Colorado have had their identity stolen. The scheme was simple and it was easy to fall victim. Identity thieves apparently used skimmers to extract credit and debit card numbers from individuals. Skimmer scams can happen when the criminal installs a “skimming” device over the card slot of an ATM, debit or credit card reader. The skimmer then reads the magnetic strip as the user unknowingly passes their card through it.

In the case of Bennett, Colorado it is believed that this was done at a local King Soopers gas pump. The skimmer is gone now and authorities are on the hunt for the thief. King Soopers has denied that any of the fraudulent activity happened at their gas pumps and authorities have also said that they knew this was a crime spree for the past few weeks. In the meantime, many of the victims who used debit cards are without those funds because its the same as using cash. The average amount stolen was around $700 and more people are coming forward every day.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Bennett, Colorado, credit card fraud, Debit Cards, Fraud, identity theft expert, Identity Theft Prevention, John Sileo, Skimmers, Skimming

We’ve all heard the standard tips about preventing identity theft and credit card fraud. But what would a real identity thief tell you if he had the chance? A recent interview with creditcards.com talks to a thief one on one and reveals the secrets

behind credit card theft.

Dan DeFelippi, who is 29 years old, was convicted of credit card fraud and ID theft in 2004. He tells consumers that: You can never be too careful.

DeFelippi, Learned at an early age how to create fake Id’s and he said it went down hill from there. He mostly made fake credit cards with real credit card information he bought online. He would then make fake Id’s to go with them and purchase big ticket items at Best Buy or Circuit City. He would turn around and sell them on Ebay for cash. DeFelippi says committing credit card fraud is still “ridiculously easy to do,” he says. “Anyone with a computer and $100 could start making money tomorrow.”

Posted in Cyber Data Security, Fraud Detection & Prevention, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: credit card fraud, credit card scam, Credit Card Thief, identity theft expert, Identity Theft Prevention, Identity Theft Speaker, John Sileo

There is a new wave of Hi-Tech Identity Theft that the average person has no idea is possible. Identity Thieves are able to steal your credit card information without even touching your wallet.

RFID, or radio-frequency identity technology was introduced to make paying for items faster and easier. What many probably didn’t expect is that the same technology can be used by thieves to get your payment information just as easily. All major credit cards that have this technology have a symbol (pictured to the right). It means that your card can communicate via electromagnetic waves to exchange data (your credit card number) between a terminal and an electronic tag attached to an object, for the purpose of identification. With a quick scan of the card, the same way you would scan it to pay for items, all of your payment information is directed towards a source or identity thief’s computer in this case.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: "Identity Theft, Contactless, Credit Card, credit card fraud, Credit Card Theft, Electronic Pickpocket, identity theft expert, Identity Theft Speaker, John Sileo, Mastercard, Payment Fraud, RFID, Skimming, Video, Visa

There is a new wave of Hi-Tech Identity Theft that the average person has no idea is possible. Identity Thieves are able to steal your credit card information without even touching your wallet.

RFID, or radio-frequency identity technology was introduced to make paying for items faster and easier. What many probably didn’t expect is that the same technology can be used by thieves to get your payment information just as easily. All major credit cards that have this technology have a symbol (pictured to the right). It means that your card can communicate via electromagnetic waves to exchange data (your credit card number) between a terminal and an electronic tag attached to an object, for the purpose of identification. With a quick scan of the card, the same way you would scan it to pay for items, all of your payment information is directed towards a source or identity thief’s computer in this case.

Posted in Identity Theft Prevention, Sileo In the News by Identity Theft Speaker John Sileo.

Tags: "Identity Theft, Contactless, Credit Card, credit card fraud, Credit Card Theft, Electronic Pickpocket, identity theft expert, Identity Theft Speaker, John Sileo, Mastercard, Payment Fraud, RFID, Skimming, Video, Visa

Any airline, or any company, for that matter, that hasn’t upgraded their fraud-protection system in the last couple of years is an open book of credit cards and financial information to hackers and thieves. Credit card abuse, where a thief enters a stolen card number on a web site, is the primary source of online fraud. A new type of online fraud specifically targets airlines – a thief hacks into a frequent flier account (which we generally protect with weak passwords) and books a ticket for an unsuspecting second victim (you and your miles being the first), who pays cash for the ticket resold to them by the thief. When you catch on, you go after the victim, not the thief, who is long gone.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Airline Fraud, Airlines, credit card fraud, Cyberfraud, Frequent Flyer, identity theft expert, Identity Theft Prevention, John Sileo, Mileage Fraud, Mileage Points, Speaker

The FTC just busted a long-running internet scam where offshore thieves set up virtual companies and stole millions of dollars from US consumers one small charge at a time.

“It was a very patient scam,” said Steve Wernikoff, a staff attorney with the FTC who is prosecuting the case. According to him, the scammers found loopholes in the credit card processing system that allowed them to set up fake U.S. companies that then ran more than a million phony credit card transactions through legitimate credit card processing companies.

The fraudsters were able to fly under the radar for so long because they only charged consumers between $ .25 and $9 and set up over 100 fake companies to pull off these transactions. In this specific case they charged over 1.35 million credit cards a total of $9.5 million dollars – those nickles and dimes really add up! Shockingly, 94% of these charges went undetected by the credit card holder because they didn’t notice an unusual charge on their credit card statements and fraud detection agencies rarely detect anything under $10.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: credit card fraud, credit card scam, Fraud, FTC, Identity Theft Prevention, Identity Theft Speaker, John Sileo, scammers, Theft, thief, Victim

Identity Theft Expert John Sileo’s Latest Fraud Report

Just as you wouldn’t want to give any personal identity information to someone via email, you want to use the same practices via text message. There is a new wave of fraud that tries to trick you with text messages appearing to be from your bank.

According to Wikipedia, SMiShing uses cell phone text messages to deliver the “bait” which entices you to divulge your personal information. The “hook” (the method used to actually “capture” your information) in the text message may be a web site URL, like it is in phishing schemes. However, it has become more common to received a texted phone number that connects to an automated voice response system. One version of this SMiShing message will look like this:

Notice – this is an automated message from (a local credit union), your ATM card has been suspended. To reactivate call urgent at 866-###-####.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Bank Fraud, cell phone safety, credit card fraud, Fraud Report, identity theft expert, Identity Theft Prevention, John Sileo, Scams, Smishing