Home | Solutions Blog | Credit Cards

Posts tagged "Credit Cards"

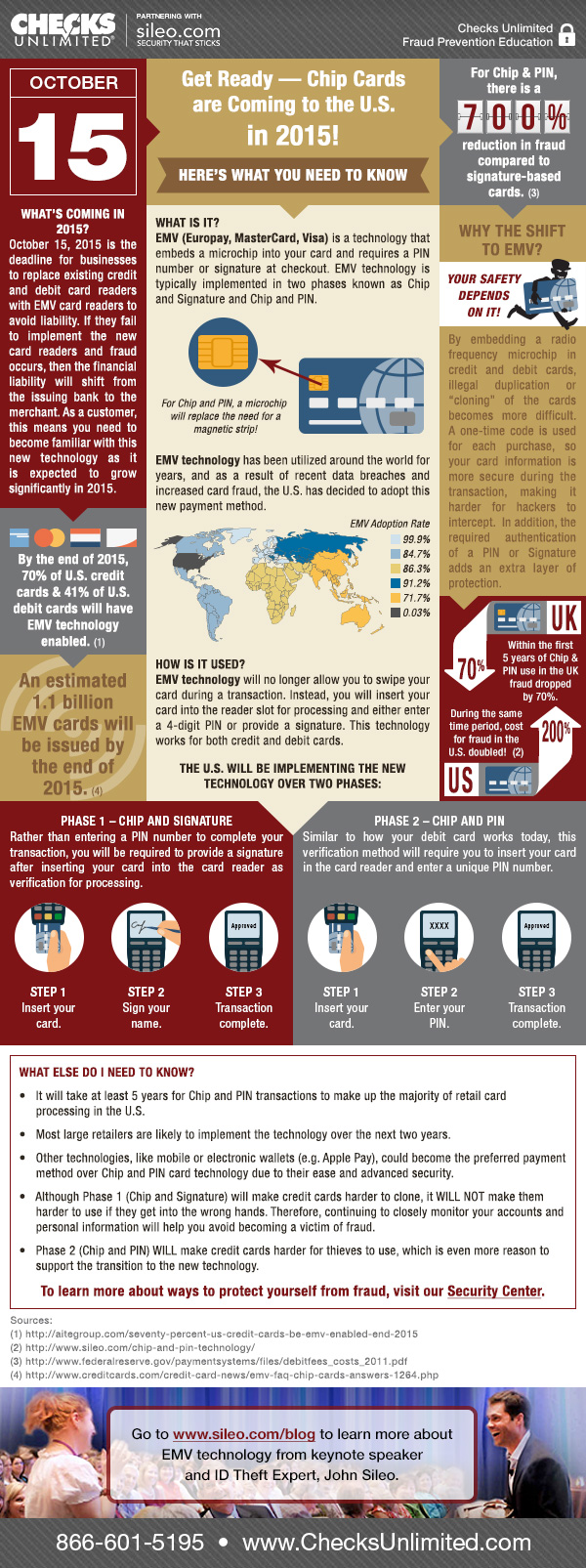

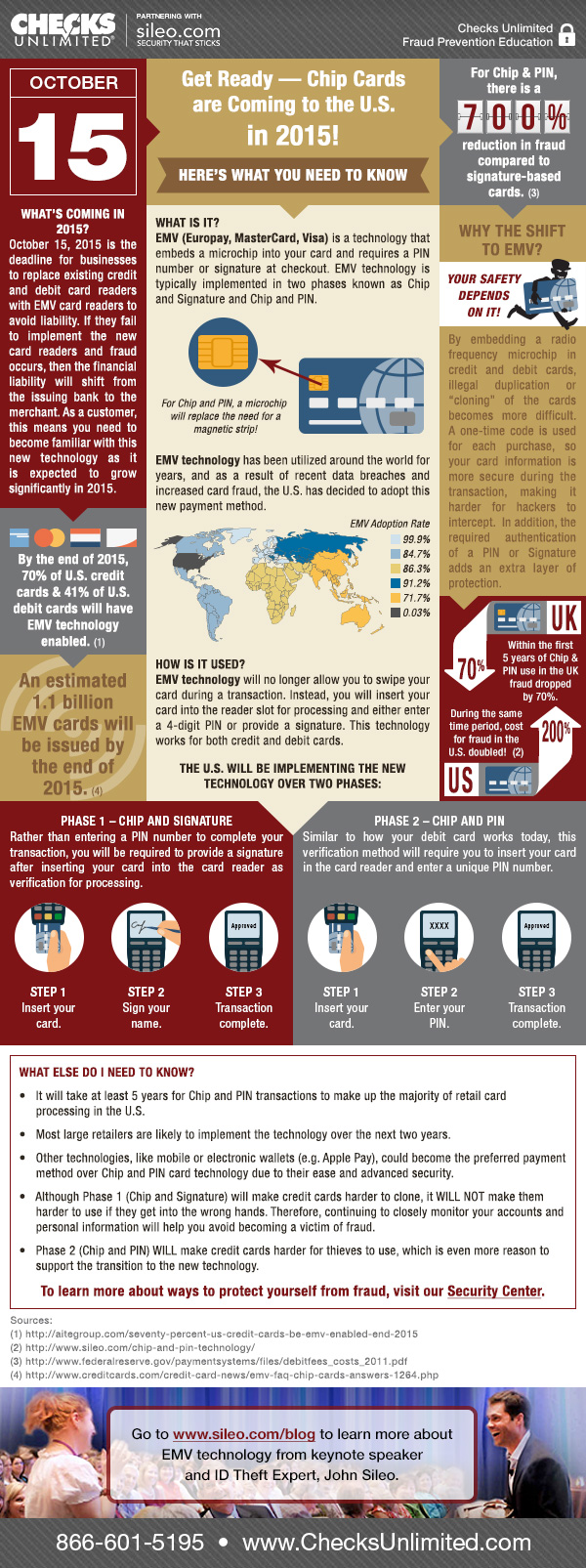

Chip and Pin Credit Cards Lower Fraud by 700%

- It will take at least 5 years for Chip and PIN (or EMV) transactions to make up the majority of retail card processing in the U.S.

- Most large retailers are likely to implement Chip and PIN technology over the next two years

- Other technologies, like mobile or electronic wallets (e.g. Apple Pay), could become the preferred payment method over Chip and PIN card technology due to their ease and advanced security.

Posted in Cyber Data Security, Fraud Detection & Prevention, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Chip and Pin, credit card fraud, Credit Card Security, Credit Cards, EMV

Holiday Security Tips: On the fourth day of Christmas, the experts gave to me, 4 pay solutions!

True or False?

When you use a debit card, funds are more secure because they are drawn directly from your bank.

False. While it’s true that funds are drawn directly from your bank, it actually makes it harder to get the money reimbursed while the issue is being resolved if fraud does occur.

You can receive a reimbursement for debit card fraud up to a year later.

False. Debit cards generally only reimburse fraudulent purchases if you catch them within 60 days.

It is safer to use a credit card than a debit card.

True. When you use a credit card, nothing is withdrawn from your bank account immediately. Pending transactions can take several days to clear. In addition, credit cards uniformly give you more protection than debit cards and your maximum liability is capped at $50.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: "High security checks", “Holiday ID Theft”, “Online scams”, “Prevent Identity Theft”, “Preventing Identity Theft”, Black Friday, Checks, Credit Cards, Cyber Monday, Debit Cards, holiday, Holiday Identity Theft, Holiday Scams, holiday security tips, Holiday Shopping, John Sileo, Sileo

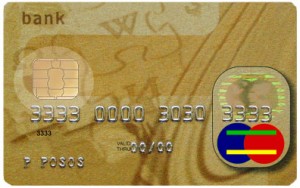

The typical US consumer still swipes their card, credit or debit, with those same old black magnetic stripes. And, we hold our breath and hope they work, and don’t lead to erroneous (fraudulent) charges we have to defend. The rest of the world has switched to Smart cards, according to Peter Svensson, The Associated Press, in The Denver Post. “The problem with that black magnetic stripe on the back of your card is that it’s about as secure as writing your account information on a post-card”.

Svensson comments “Smart-cards (chip-based cards) can’t be copied, which greatly reduces the potential for fraud. Smart cards with built-in chips are the equivalent of a safe: They can hide information so it can be unlocked only with the right key”.

Posted in Cyber Data Security, Fraud Detection & Prevention, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Chip, Credit Card, Credit Cards, Financial, Keynote Speaker, Security, Sileo, Smart Card, Smart Cards, Technology

This week’s news of the theft of private data comes from Citigroup. Seems that even the most reputable organizations can be exposed to the ever-more frequent data breaches we read about. You’ll likely recall the recent news of Sony, PBS, Epsilon and Lockheed Martin. Regrettably, the list is growing by the day. It affects me, and likely, it affects you. Now what?

First, arm yourself with the facts. See the attached articles.

- http://blogs.wsj.com/deals/2011/06/09/citigroup-data-breach-4-tips-to-protect-yourself/

- http://www.reuters.com/article/2011/06/09/us-citi-idUSTRE7580TM20110609

- http://www.informationweek.com/news/181502068

Second, remember to protect your most important data (this information, on its own, or in any combination, is a jackpot to an identity thief):

- Social Security number

- Date of birth

- PIN

- Credit Card numbers

- Bank Account numbers

- Birthdate

Third, never reply to an e-mail requesting personal information. Unless you originate the communication, suspect the worst and do not respond. This is referred to as “Phishing” and the results are never good.

Posted in Cyber Data Security, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: breach, Citi, Citibank, Citigroup, Credit Cards, Expert, Identity Theft Prevention, John Sileo