Home | Solutions Blog | Data Breach

Posts tagged "Data Breach"

How to Protect Yourself from the Equifax Data Breach

Equifax, one of the three major consumer credit reporting agencies disclosed that hackers compromised Social Security and driver’s license numbers as well as names, birthdates, addresses and some credit cards on more than 143 million Americans. If you have a credit profile, you were probably affected.

Credit reporting companies collect and sell vast troves of consumer data from your buying habits to your credit worthiness, making this quite possibly the most destructive data security breach in history. By hacking Equifax, the criminals were able to get all of your personally identifying information in a one-stop shop. This is the third major cybersecurity breach at Equifax since 2015, demonstrating that they continue to place profits over consumer protection. Ultimately, their negligence will erode their margins, their credibility and their position as one of the big three.

Posted in Cyber Data Security, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: “security breach”, Credit Freeze, Cyber Security, Cybersecurity Expert, Data Breach, Equifax 2017 Breach, Equifax Data Breach, John Sileo, Security Freeze

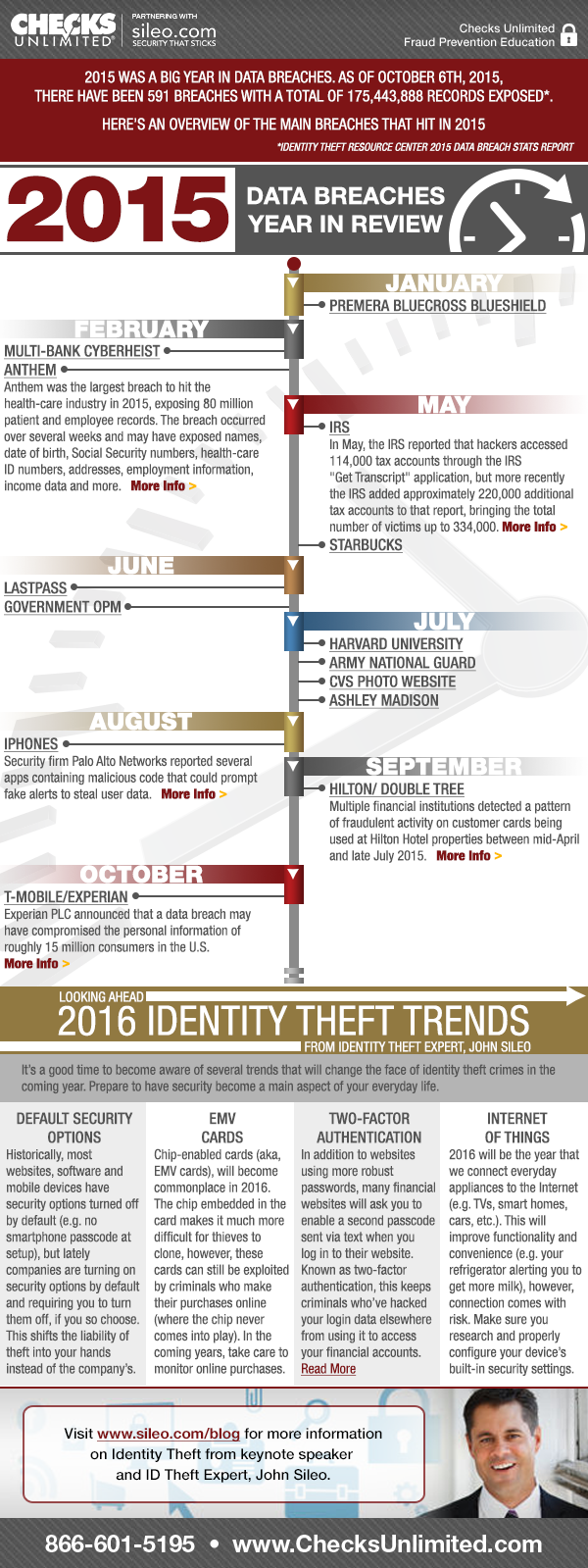

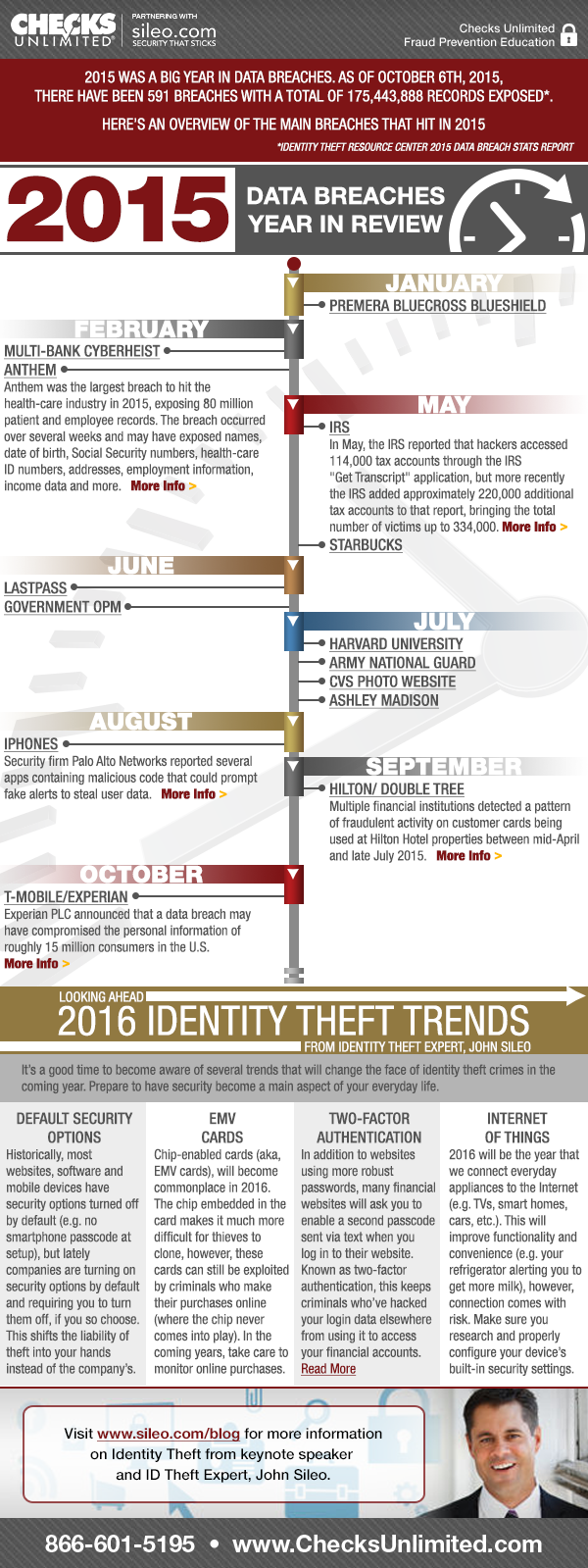

Influential Cyber Data Breach 2015

January Data Breach

Premera BlueCross BlueShield

Health insurance company Premera BlueCross BlueShield said in March that it had discovered a breach in January that affected as many as 11.2 million subscribers, as well as some individuals who do business with the company. The breach compromised subscriber data, which includes names, birth dates, Social Security numbers, bank account information, addresses and other information.

February Cyber Breach

Multi-Bank Cyberheist

In February, a billion-dollar bank cyberheist was discovered, affecting as many as 100 banks around the world. The breaches, discovered by Kaspersky Lab, infiltrated the banks’ networks using tactics such as phishing and gaining access to key resources, including employee account credentials and privileges. The cybercriminal ring, known as Carbanak, then used those credentials to make fraudulent transfers and make hijacked ATM machines appear legitimate as they funneled more than $1 billion into their own pockets.

Anthem

Anthem revealed a breach in February that exposed 80 million patient and employee records. Anthem said the breach occurred over several weeks, beginning in December 2014, and could have exposed names, date of birth, Social Security numbers, health-care ID numbers, home addresses, email addresses, employment information, income data and more. It said it did not believe banking information was taken. The Wall Street Journal reported that Anthem had not encrypted the data that was accessed by hackers.

Posted in Cyber Data Security by Identity Theft Speaker John Sileo.

Tags: "Data Breach 2015", Data Breach, John Sileo, Sileo

Come on, admit it. Don’t you feel just a little satisfaction watching 37 million adulterers exposed in the Ashley Madison hack? “They do kind of deserve to be cheated just a bit for being cheaters,” someone in one of my keynote speeches commented.

In this case, the hackers weren’t seeking money, they were seeking revenge. Their goal was to get Ashley Madison to shut down the site because they said it wasn’t living up to it’s own privacy policy (they weren’t). But to side with the hackers is a bit like saying it’s okay to pepper spray customers to keep them from going into a store you’re morally opposed to. In other words, be careful when you condone the use of customers as pawns to fuel change. You just might be the next customer to become a victim, and your data could be just as sensitive (your medical records, divorce proceedings, kids’ geographical location or your online video viewing habits).

Posted in Cyber Data Security, Identity Theft Prevention, Online Privacy by Identity Theft Speaker John Sileo.

Tags: “Ashley Madison hack”, “Ashley Madison”, Ashley Madison Breach, Cyber Security Expert, Data Breach, John Sileo, Sileo

What’s the Anthem breach?

- More than 80 million patient records were stolen out of Anthem’s servers.

- If you are an Anthem, Blue Cross or Blue Shield customer, now or in the past, you are probably affected by the breach.

- The data stolen included at least Social Security numbers, birthdates, addresses, email addresses and employment information.

- Not included in the breach (or at least disclosed as being part) were credit card numbers or medical data.

Why is the Anthem breach so serious?

- When breach includes so much data on each victim, especially your Social Security number, it makes it fairly easy for cyber criminals and identity thieves to create new accounts in your name or takeover existing financial accounts. In other words, they can bank as you, borrow as you and pose as you in order to financially exploit you.

Posted in Cyber Data Security, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Anthem Breach, Data Breach, Data Breach Expert, data security breach, John Sileo

Home Depot Data Breach Exposes Our Growing Complacency

When Target suffered a data breach back in December of 2013, you couldn’t look at a news source without seeing a new story about it. Yet when the Home Depot data breach was revealed recently, it received almost a ho-hum reception in the news. This, even though, it was the biggest data breach in retailing history and has compromised 56 million of its customers’ credit cards! It seems we have come to expect these data breaches to the point where we have become almost complacent.

Consumers, like the companies that breach our data, have become apocalyptic zombies, staring unquestioningly forward as we are attacked from all sides.

Posted in Cyber Data Security, Fraud Detection & Prevention by Identity Theft Speaker John Sileo.

Tags: "Home Depot Data Breach", "Home Depot", Cyber Security Expert, Data Breach, John Sileo, Sileo

When JP Morgan was recently asked about reported cyber attacks, their spokesperson replied that they were “closely safeguarding information and would notify anyone affected” and went on to add that companies of its size experience cyber attacks “nearly every day”. It seems a rather casual reply for an event that may have resulted in the theft of multiple gigabytes of sensitive data!

Yet that is the reality today. In fact, the financial industry, and most of the business world, has been described as being in a state of almost perpetual cybersiege. Cyber attacks have become so commonplace that most businesses have almost come to expect it.

Which is why we have stopped paying attention, because breach is so normal. And breach is so normal because corporations don’t train their employees correctly on how to avoid it.

Posted in Cyber Data Security by Identity Theft Speaker John Sileo.

Tags: "Cyber attacks", Chase Breach, Cyber, Cyberseige, Data Breach, John Sileo, Sileo

Data Breach Expert Alert: The restaurant chain P.F. Chang’s China Bistro has reported a security breach that may have led to the theft of customer data from credit and debit cards used at 33 restaurants. In addition to stolen card numbers, the intruder may have gotten names and expiration dates as well. The breach took place between October 19th of 2013 and June 11th of 2014 and supposedly has affected 33 locations.

Data Breach Expert Alert: The restaurant chain P.F. Chang’s China Bistro has reported a security breach that may have led to the theft of customer data from credit and debit cards used at 33 restaurants. In addition to stolen card numbers, the intruder may have gotten names and expiration dates as well. The breach took place between October 19th of 2013 and June 11th of 2014 and supposedly has affected 33 locations.

If P.F. Changs follows in the footsteps of the recent Target breach, you can expect an expanding number of stores and customers affected over the coming days. It seems that the data breach playbook suggests that companies initially under-report the severity of the security lapse in order to keep customer shock and defection to a minimum. Once the news cycle has worn out the topic (generally 3-5 days), the breached company generally issues news on additional stores affected, customer data lost, increases in the actual data affected, etc. Let’s hope P.F. Chang’s does a better job of communicating damage the first time.

Posted in Cyber Data Security by Identity Theft Speaker John Sileo.

Tags: Data Breach, Data Breach Expert, John Sileo, P.F. Changs, PF Changs, Sileo

It’s no surprise that identity theft once again tops the “Dirty Dozen” tax scams put forth by the IRS for 2014. They warn that if an identity thief has access to your personal information, such as your name, Social Security number or other identifying information, he or she may use it to fraudulently file a tax return and claim a refund in your name. Think of the implications for the 110 million victims of the recent Target data breach as well as victims of the hundreds of other breaches at other retailers, universities, healthcare providers, government agencies and so on.

It’s no surprise that identity theft once again tops the “Dirty Dozen” tax scams put forth by the IRS for 2014. They warn that if an identity thief has access to your personal information, such as your name, Social Security number or other identifying information, he or she may use it to fraudulently file a tax return and claim a refund in your name. Think of the implications for the 110 million victims of the recent Target data breach as well as victims of the hundreds of other breaches at other retailers, universities, healthcare providers, government agencies and so on.

KrebsOnSecurity reports that the information from the Target breach alone has reportedly flooded underground black markets and cards are being sold from around $20 to more than $100 each. This data is being sold in hundreds of online “stores” advertised in cybercrime forums. A fraud analyst at a major bank was able to buy a portion of the bank’s accounts from such a store.

Posted in Fraud Detection & Prevention, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: "Identity Theft, “IRS dirty dozen”, “tax scams”, Data Breach, Expert, identity theft expert, John Sileo, Online Reputation, Sileo, Speaker

Universities perfect learning environment for data security

Higher Ed Organizations are among the highest risk groups to become victims of identity theft and data breach. Because students are relative “beginners” when it comes to personal finances, because university environments are predicated on trust and credibility, and because of the recent progress towards a mobile-centric, social-networking-dominated campus, higher education’s digital footprint is constantly exposed to manipulation.

“The most engaging speaker I’ve ever heard – period.” Debbie Bumpous, NSU Chief Information Technology Officer speaking about John Sileo

“John Sileo was the secret sauce in launching our cyber security awareness program” – University of Massachusetts Director of IT

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: "Higher Education", "Identity Theft, Data Breach, data privacy expert, data security, Data Security Expert, identity theft expert, John Sileo, Privacy, Universities, University

Data Breach Expert Alert: The restaurant chain P.F. Chang’s China Bistro has reported a security breach that may have led to the theft of customer data from credit and debit cards used at 33 restaurants. In addition to stolen card numbers, the intruder may have gotten names and expiration dates as well. The breach took place between

Data Breach Expert Alert: The restaurant chain P.F. Chang’s China Bistro has reported a security breach that may have led to the theft of customer data from credit and debit cards used at 33 restaurants. In addition to stolen card numbers, the intruder may have gotten names and expiration dates as well. The breach took place between  It’s no surprise that identity theft once again tops the

It’s no surprise that identity theft once again tops the