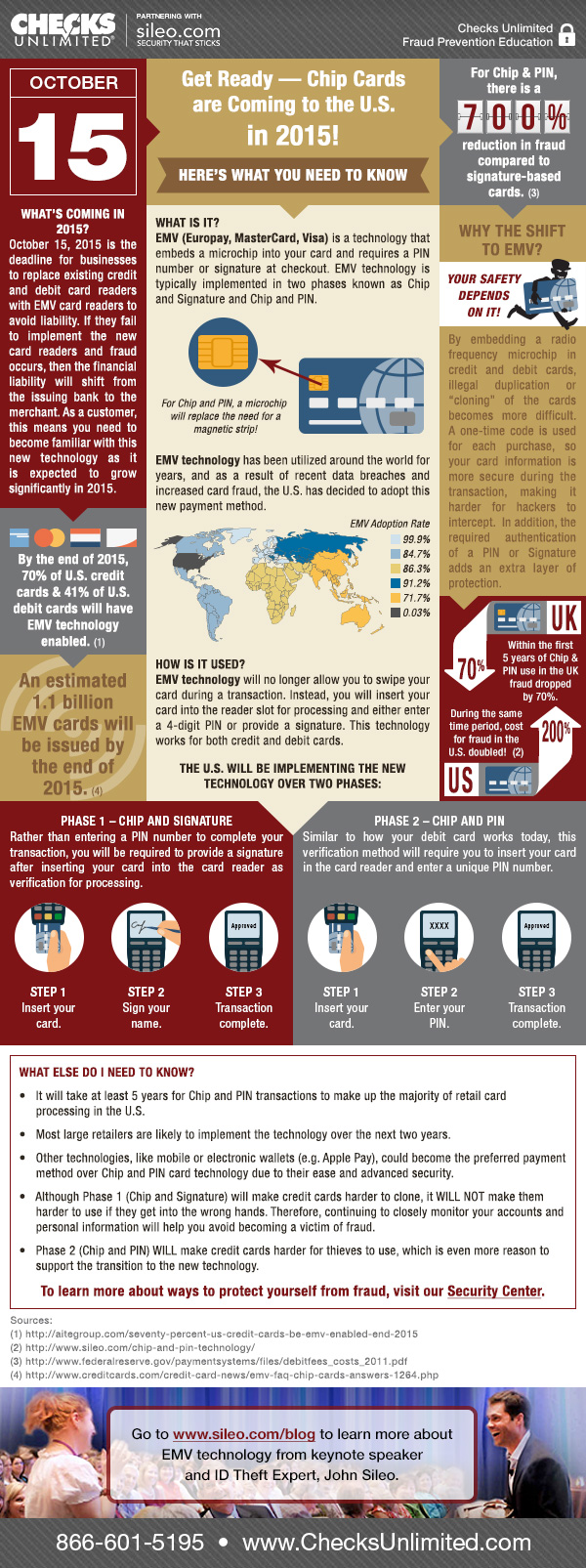

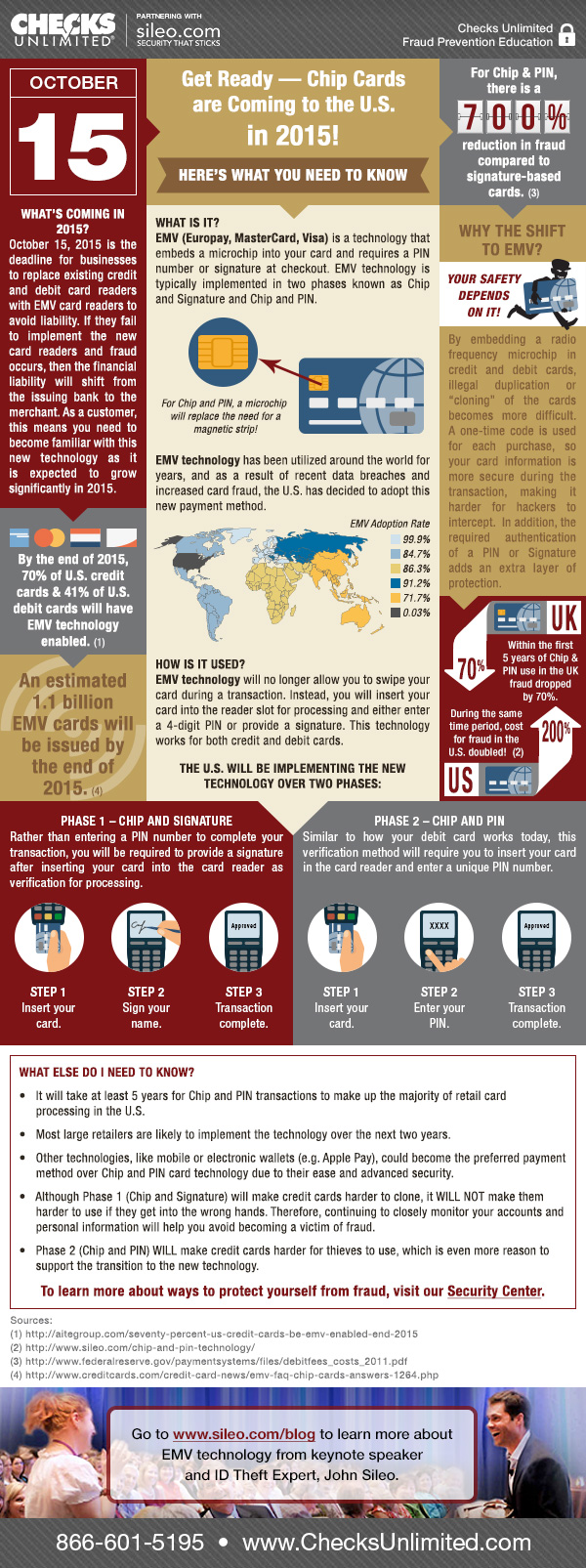

Chip and Pin Credit Cards Lower Fraud by 700%

- It will take at least 5 years for Chip and PIN (or EMV) transactions to make up the majority of retail card processing in the U.S.

- Most large retailers are likely to implement Chip and PIN technology over the next two years

- Other technologies, like mobile or electronic wallets (e.g. Apple Pay), could become the preferred payment method over Chip and PIN card technology due to their ease and advanced security.

Posted in Cyber Data Security, Fraud Detection & Prevention, Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Chip and Pin, credit card fraud, Credit Card Security, Credit Cards, EMV

Quite a while ago, not long after the Target data breach, I wrote a detailed blog about the importance of the United States catching up to more than 80 other countries who already employ EMV security measures for their credit and debit cards. (EMV refers to “Europay, Mastercard, and Visa” or “Chip and PIN” technology.) Why so important? This one statistic should answer that question: Almost half of the world’s credit card fraud now happens in the United States —even though only a quarter of all credit card transactions happen here.

As a consumer, you should be glad of the change because you will be much better protected than with traditional magnetic stripe technology we’ve clung to for so long. EMV authentication includes a cryptographic message that makes each transaction unique. Having a card that is difficult to hack or duplicate and requires something YOU know (a PIN) will provide extra layers of protection.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: EMV, EMV Security, John Sileo, Sileo