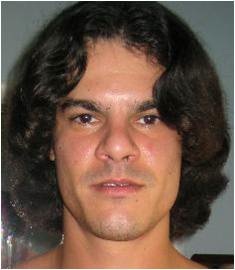

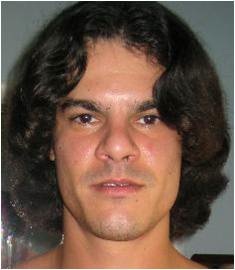

Albert Gonzalez, the Miami hacker who creeped into the systems of Heartland Payment Systems, TJ Maxx and 7-Eleven plead guilty last week to the cyber crimes that stole over 130 million debit and credit card records. He previously plead guilty in September in a separate case where he stole 40 million credit and debit card information. In the latest case he could now serve no less than 17, but no more than 25 years for the theft of payment card details from the compromised systems. Not too tough a sentence for someone who stole from over 170 million of us!

Gonzalez’s attorney claimed a mix of Internet Addiction, Asperger’s Syndrome and alcohol abuse for this identity information theft. Although, when he plead guilty in September, Gonzalez admitted he led an international ring that stole credit and debit card records from U.S. retailers including Naperville-based OfficeMax Inc. and BJ’s Wholesale Club Inc. The question still remains if those that worked with him will even be found, let alone prosecuted. The light punishment doesn’t seem to fit the extensive ring of information theft and identity crimes that Gonzales committed.

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: Heartland, Identity Theft Prevention, information theft, Theft Information

Albert "Segvec" Gonzalez

Operation Get Rich or Die Tryin is the name that Albert Gonzalez gave to his scheme of stealing more than 130 million credit and debit card numbers from you and me. Today, Gonzalez, along with two unnamed Russian conspirators, was indicted in the state of New Jersey. Gonzalez, known by his alias of Segvec, was part of a cyber-crime ring that hacked into the computer systems of at least five major companies, including Heartland Payment Systems, 7-Eleven, TJMAXX, Hannaford Bros. Super Markets and Dave & Busters.

This is likely the largest case of identity theft ever prosecuted, comprising more that 130 million card numbers

Tactics: Gonzalez and his conspirators reviewed Fortune 500 Companies, performed reconnaissance on their retail stores, determined weaknesses in their payment systems and then utilized malware (malicious software) to intercept credit card numbers, expiration dates and names as they were transmitted from company to company

Posted in Identity Theft Prevention by Identity Theft Speaker John Sileo.

Tags: albert gonzalez, Credit Card, get rich or die tryin, Heartland, segvec