Identity Theft Victim? YOUR NEXT 3 MOVES ARE ABSOLUTELY CRITICAL!

[youtube http://www.youtube.com/watch?v=N31vpnK_q0M&rel=0]

Do you know that panicked feeling, sweaty-hot pins and needles…

when you realize that you’ve lost your wallet or mobile phone? Gone are your credit and debit cards, driver’s license and maybe even checks or a Social Security card. Your phone might house addresses and phone numbers for your loved ones, passwords and logins for your financial accounts, and even access to your email program (allowing someone else to email as you, let alone make calls as you). While the wallet might contain cash and the mobile phone is expensive, they are worth virtually nothing compared to the value of the sensitive (and sellable) data they contain.

Or maybe you received a letter from a company (like Target), warning that your private information was hacked in a data breach. No matter how you discover it, identity theft is disturbing enough to cause sleepless nights and powerful enough to consume most of your wealth (as it did mine – watch the video). More than 200 million records were breached last year alone, accounting for an average of one data-loss incident per American adult. A new identity theft victim is hit EVERY TWO SECONDS and the number of yearly victims has risen to 13.1 million*, which signifies substantial growth in what has been America’s fastest growing crime for the past 10 years.

You get the point – lost wallets, stolen purses, missing mobile phones and laptops, devious dumpster divers and hacked databases all add up to a desperate need for comprehensive identity theft recovery. So here’s the big secret: to be effective, ID theft recovery has to be started immediately and must take place in a very specific order.

The Identity Theft Recovery Steps you take today could change your life…

The problem with most advice on identity theft recovery is that it is given out of order, using flawed procedures. Some “experts” tell you to file a police report first, all while the thief continues to cash out your accounts. Or they have you freeze your credit before you have expunged fraudulent accounts, making it nearly impossible to repair your credit history. Order matters. Speed matters. And the method by which you dispute fraud makes all the difference in the world to how fully and quickly you recover. Here are the first 3 steps you should take (excerpts from the complete Identity Theft Recovery Guide) if you feel that you are a victim of identity theft (e.g., lost or stolen wallet, mobile phone, tablet, laptop, violated garbage containers, burgled home, etc.):

1. Don’t Panic.

You want to proceed quickly, not irrationally. The tendency to begin taking steps before you have catalogued what is missing will lead to mistakes down the road. Take a deep breath, come to terms with the fact that you are in for a good deal of work, and believe in your ability to recover from this. Your first step is to take an inventory of every missing item including physical assets (wallets, laptops, etc.), digital assets (mobile phones, electronic files, USB drives, etc.) and online assets (logins and passwords). This will serve as a checklist of risk areas that need to be solved over the coming days. In less than 48 hours, you will begin to forget the items that were lost or stolen, so don’t waste time. Until you understand what is missing, it’s hard to know where to begin. Here is a sample inventory of frequently stolen items:

- Social Security cards, statements or related documents

- Birth certificates, death certificates, passports and drivers licenses

- Wallets, purses, computer bags as well as the contents of those items

- Checkbooks, contact lists, passwords, files, folders and boxes of extra checks

- All financial records, including bank, brokerage, mortgage, credit card, and insurance

- All digital devices containing sensitive information, including laptops, computers, cell phones, tablets, USB drives…

- Digital files, including passwords, tax documents, contact lists and work-related assets

- Any compromised internet logins, including social media, banking, brokerage and e-commerce sites

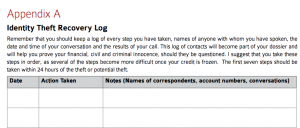

2. Start an Identity Theft Recovery Log.

Over the next couple of weeks, tracking what you do is going to be important. As you take the following steps, you should keep a log of every step you have taken, with whom you spoke, the date and time of your conversation and the results of your call. This log of contacts will become part of your recovery dossier and will help you prove your financial, civil and criminal innocence, should they be questioned. I recommend that you complete and log the first seven steps in the Guide within 24 hours of detection or potential theft to draw a virtual line in the sand that establishes a fraud “born on” date. This makes it easier to prove your innocence in regard to fraudulent transactions completed after that date. See a sample log from the Guide, above.

3. Deactivate the Affected Accounts.

The quickest way to minimize ID theft damage is to quickly deactivate any affected accounts – financial or otherwise. If there is a specific account involved that you feel has been violated, shut that account down first (or at least change the account number). For example, if your credit card has been stolen, alert that specific credit card company and deactivate the affected card. Some experts warn you not to cancel the card as it might make it more difficult to track the crime. From experience, your crime will never even be investigated, let alone solved, so protect yourself and change or cancel the account. If it is a bank or brokerage account, have them suspend all capabilities on the account until you notify them of next steps. For credit cards, under federal law, you are only responsible for a maximum of $50 if you report the fraudulent charges immediately. Debit cards have higher liabilities and the money will be absent from your account while you prove that you didn’t make the withdrawal. Further deactivation steps are discussed in the Guide.

In total, there are 31 unique steps for you to consider during the recovery process, including filing victim and police reports, locking criminals out of your credit, taxes and medical benefits, as well as defending your online accounts, children’s identity and safeguarding your financial investments.

For a highly detailed, step-by-step recovery process, I’ve created a complete system to walk you through every step of the process, titled the Identity Theft Recovery Guide. The Guide includes prioritized checklists, forms, links, phone numbers and videos to walk you quickly through the entire process of recovering your identity.

For a highly detailed, step-by-step recovery process, I’ve created a complete system to walk you through every step of the process, titled the Identity Theft Recovery Guide. The Guide includes prioritized checklists, forms, links, phone numbers and videos to walk you quickly through the entire process of recovering your identity.

Learn more about my comprehensive system for protecting your wealth, good name and peace of mind by clicking on the link below. The sooner you start, the less you will lose.

John Sileo is the award-winning author of four books on identity theft, social media privacy and mobile technology, including The Identity Theft Recovery Guide.. John delivers keynote speeches to conferences and companies that don’t want to end up as the next data breach headline. His clients included the Department of Defense, Pfizer, Visa and Homeland Security. Watch John keynoting, on Rachael Ray, or through the eyes of his clients.

*Javelin Strategy & Research Identity Fraud Report, February, 2014.

Sorry, comments for this entry are closed at this time.

No Comments Yet

You can be the first to comment!